Identifying Market Participant Groups by Patterns

The StockCharts.com indicator Accum/Dist was designed to help track the large lot activity versus

the small lot activity. Decades ago when the concept of distinguishing between

the large lots versus small lots started being discussed by the Sell Side

Institutions, the Stock Market was an entirely different Market Structure.

Almost all orders

were filled on the exchanges via Market Makers. Few were filled off the

exchanges via dealers and professional side brokers. The only access the retail

crowd had was through a broker who typically charge $75-$100 per

transaction.

There were Mutual

Funds in the market but no Pension Funds and the number of Market Participant

Groups was 5 not 9, so the interpretation of this indicator was simpler. Thus, what

you read everywhere is based on that era.

Now the Stock Market

is more complex because there are 9 distinctly different Market Participant

Groups which each have different order types, venues, order sizes, agendas, and

vast disperities of knowledge and INFORMATION. By the time the retail crowd

gets the news, it is old news to just about every other Market Participant

Group.

Watch

the TechniTrader

If you want to use

accumulation indicators you need to approach their use properly for the current

Stock Market of today, not what it was many decades ago. If you use outdated

training then you will be wrong much of the time in your analysis.

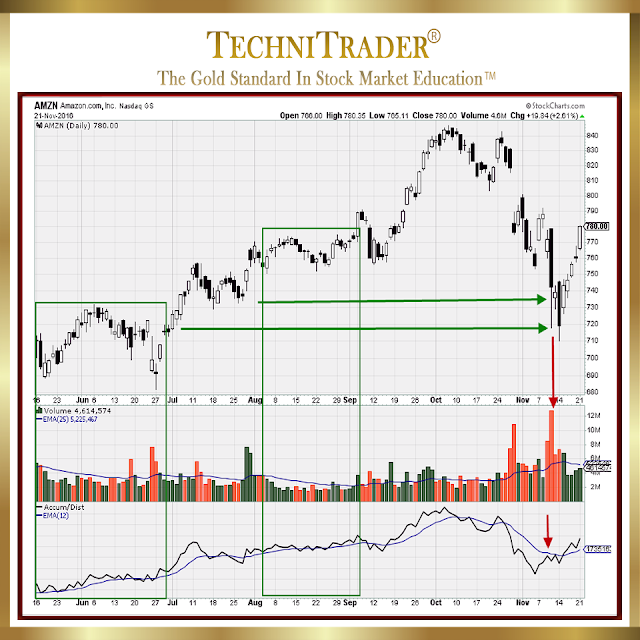

When analyzing a

stock using Accum/Dist you MUST use Relational Analysis™ because is more

complete. This type of analysis combines Price via Candlestick Patterns, Trend

and Trendline Patterns Volume, and Accum/Dist as shown in the chart example

Amazon.com, Inc. (AMZN: NASDAQ) below.

The footprint of each

different Market Participant Group is in the combination of these on the chart

and can be found in Price, Volume, and Accumulation/Distribution.

Price shows use the

magnitude of the daily price action which tells us whether it was contained and

controlled via Time-Weighted Average Price TWAPs OR if High Frequency Traders

HFTs were creating huge price action as one example. Each group has its own

candlestick amplitude that group creates, often deliberately based on the ORDER

TYPE they prefer to use and the VENUE they typically use.

Trend and Trendline

Patterns tell you who is trading OR investing in the stock. Dark Pools do not

buy stocks that are topping. They prefer to buy in bottoms and their Buy Zones.

Volume defines the quantity

of orders flowing through on an given day. Dark Pools deliberately use TWAPs

which fire off over a longer period of time, usually several days to weeks. So

their gigantic quantities are spread out lowering Volume rather than spiking

Volume. It is HFTs that spike Volume. Professional Traders ease Volume above

its average to entice Retail Traders into the stock. Smaller Funds tend to

surge Volume.

Accumulation is a consistent

buying pattern over time. One day of Accum/Dist or my TechniTrader Quiet

Accumulation TTQA indicator does not provide the analysis. The TTQA histogram

looks similar to the Volume indicator but can show contrarian patterns to

Volume. It is the appearance of the line or histogram, that tells you

whether the buying OR selling is incremetal and consistent meaning Dark Pool

activity OR if it is sudden and spiking.

As an example of how

to interpret the downward action recently for AMZN, there is a Price at market

open gap down on October 28, a Volume Spike, and a severe sudden Angle of

Descent™ on Accum/Dist which is a HFT footprint. Trend tells us that prior to

this Professional Traders moved price up but took profits as the stock formed a

short-term top, due to their profit taking into Retail Traders buying at the

first of October. This profit taking awakened HFTs.

So that pattern in

combination tells us this is NOT Dark Pools or Professional Traders, but HFTs

action. Over the next few days the stock runs down on Small Funds

Volume-Weighted Average Price VWAP orders, that trigger any time there is a

huge Volume spike. The spikes in Volume are always created by HFTs, not Dark

Pools who spread out their buying or selling to avoid this pattern.

Then AMZN price falls

into a Dark Pool Buy Zone. HFTs attempt another big sell down day on November

10, but this time that fails as the Buy Zone triggers TWAP orders moving price

up along with Proesssional Traders intraday buying.

Smaller Funds VWAPs

sell the stock down again on November 14, but they are unaware they are selling

into a Buy Zone which is clearly defined in the stock chart via Price, Volume,

and Accum/Dist indicator. Professional Traders move stock out of the Buy Zone

even as Smaller Funds continue to sell.

Summary

In order to use

Accum/Dist properly you must know what Price, Volume, and

Accumulation/Distribution Pattern each Market Participant Group creates on

the chart. Just seeing Accum/Dist tick upward does not tell you enough, because

you have no idea who ticked it up. Dark Pools prefer to accumulate in the

summer, because retail is busy on vacation and most in the retail group thinks

it is a bad time to trade stocks.

Go

to the TechniTrader

Followers of this

blog may request a specific article topic by emailing: info@technitrader.com

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a StockCharts chart, courtesy of StockCharts.com

Chartered Market Technician

Instructor & Developer of TechniTrader Stock and Option Courses

TechniTrader DVDs with every course.

©2016–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.

Disclaimer: All statements are the opinions of TechniTrader, its instructors and/or employees, and are not to be construed as anything more than an opinion. TechniTrader is not a broker or an investment advisor; it is strictly an educational service. There is risk in trading financial assets and derivatives. Due diligence is required for any investment. It should not be assumed that the methods or techniques presented cannot result in losses. Examples presented are for educational purposes only.