The Importance of a Volume Oscillator Indicator

The most difficult

aspect of reading stock charts for most Technical and Retail Traders are the

sideways patterns. Many traders simply do not know how to interpret sideways

patterns, to determine in advance whether the stock will move up or down out of

the sideways pattern.

Learning to read

sideways patterns requires not only candlestick analysis, but also the proper

indicators that help. One extremely useful indicator is the StockCharts.com

ChiOsc Indicator, which is a volume oscillator. Most Retail Traders are not

familiar with volume oscillators. In our modern automated, multi-venue Stock

Market they have become essential indicators for those who want to make a

living trading stocks, or those who wish to augment their income from trading

stocks or options.

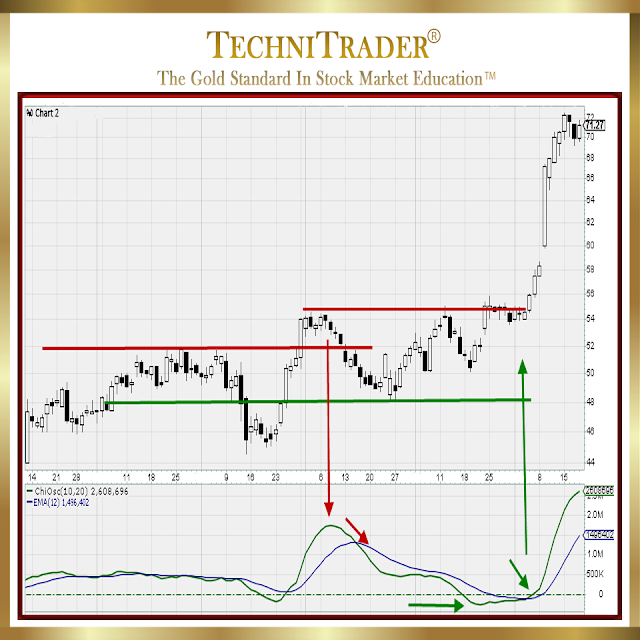

The chart example

below is a fine example of the importance of a volume oscillator for

identifying breakout patterns prior to Momentum Runs. I have drawn red lines to

indicate Resistance, and a green line to indicate Support. I have also blocked

out the right side of the chart, and the indicator window.

Unlike price

oscillators the analysis is not overbought or oversold, but rather overextended

patterns either at the high or low of a run. This provides invaluable analysis

for Day, Swing, Momentum, and Position Trading, which is not to be confused with

Positional Trading.

Go watch the Swing Trading Video to learn about precision entries

and exits, and how to use leading indicators to enter before price moves.

Go

to TechniTrader

The sideways pattern

in this chart example has many important factors to study in the candlesticks,

but without a volume oscillator for Relational Analysis™ they are lost.

The stock moved above

a moderate resistance level but then retraced. Why? Price alone does not

explain why nor does it warn that the support would not hold, which is a

problem for Short-term Traders, who might assume that moderate support should

hold.

Support does not halt

the run down until well beyond the prior moderate support lows. Why? The

candlesticks alone do not explain this price action.

More importantly will

the current price action be able to break to the upside, or will it go back

down and run down again? Price alone does not indicate what will happen next.

Will the stock move up or will it move down. If you want to be a highly

successful and profitable trader, this is a BASIC question that you must be

able to answer.

Now let’s look at the

same chart with the ChiOsc volume oscillator window added. See the chart

example below.

Volume oscillators

have far more signals, patterns, and analysis than overbought/oversold price

indicators. It does take more time to learn how to interpret them properly, but

it is time well spent. The Why of price action is in VOLUME for identifying

breakout patterns prior to Momentum Runs.

Go watch the Best

Volume Indicators Training Webinar, to learn why volume is as important as

price analysis, and why volume leads price.

Go to the TechniTrader

For the failed

attempt to break to the upside and sustain the price above the highs of the

prior resistance, volume shows clearly an overextended pattern that quickly

declines even BEFORE price drops down after the consolidation. Leading price,

the ChiOsc Indicator tells you the volume is insufficient for the stock to hold

this price. The indicator also shows during the run down that it will go beyond

the lows of that consolidation.

Then the ChiOsc

troughs above the low of the chart, angling upward even while price once again

consolidates below the moderate resistance level. The crossover is a signal

that confirms the candlestick buy entry signal. This provides a low risk entry

before the stock moves with momentum.

The final extreme

overextended ChiOsc Indicator pattern indicates High Frequency Traders have

taken control of price, and the stock will stall in its run up or encounter

profit taking.

Go to the Learning

Center and watch a wide variety of training webinars including Bollinger Bands,

How to Trade Stocks, Candlestick Patterns, and Technical Analysis.

Go

to the TechniTrader

Summary

Volume oscillators are

one of the most important indicators for trading the automated market where

more and more professionals are using alternative trading venues which leave

the Retail Trader in the dark. Price oscillators offer minimal help. Volume

oscillators show why price is behaving as it is, and indicate how price will

move in the near term.

Beginners go watch

“The Basics of the Stock Market for New Investors and Beginning Traders” 12

Webinar Lessons.

Go

to the TechniTrader

“Basics of Stock Market New Investors & Beginning Traders”

12 Webinar Lessons

TechniTrader

The

Gold Standard in Stock Market Education

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a StockCharts chart, courtesy of StockCharts.com

Chartered Market Technician

Instructor & Developer of TechniTrader Stock and Option Courses

TechniTrader DVDs with every course.

©2016–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.

Disclaimer: All statements are the opinions of TechniTrader, its instructors and/or employees, and are not to be construed as anything more than an opinion. TechniTrader is not a broker or an investment advisor; it is strictly an educational service. There is risk in trading financial assets and derivatives. Due diligence is required for any investment. It should not be assumed that the methods or techniques presented cannot result in losses. Examples presented are for educational purposes only.