How to Identify Early Shift of Sentiment™ Bottoms

One question every

Trader is asking right now is, “When will this Correction end?” A better

question is, “How do I determine a particular stock will soon start a Bottom

Formation?”

Every Technical and

Retail Trader knows that Bottoms are often completed with a Momentum or

Velocity run, but few are able to capture that big gain because they are unable

to recognize the patterns that precede it. Instead most Technical Traders chase

the run, and either net a mediocre profit or have a small loss instead of the

big gains they wanted.

It is a simple matter

of knowing what to look for during a Correction that will indicate BEFORE the

momentum of a Short Term Bottom or Rebound, that the stock has hit a Dark Pool

Buy Zone™ and will start a Bottom shortly thereafter. “Relational Analysis™” is

what I call this early kind of identification.

The following are

several factors to look for in a chart, which reveal Dark Pool Buy Zones:

1 1. Price action

2 2. Volume

3 3. Support levels

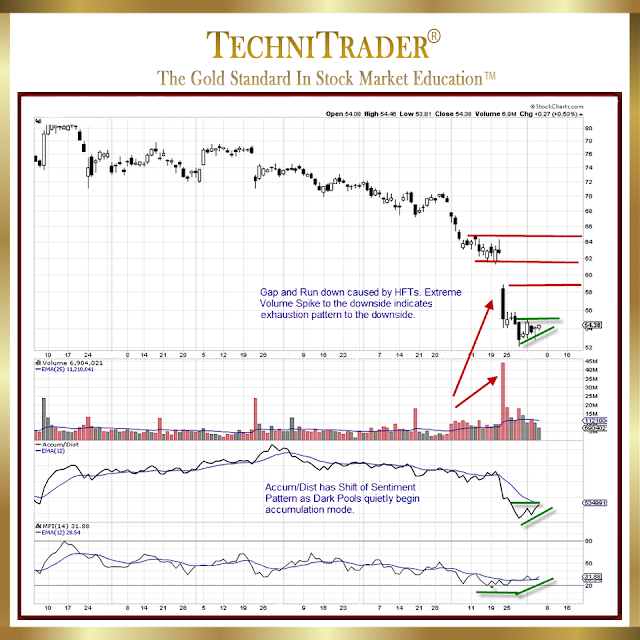

The chart example

below shows one of the new classic Price, Volume, and Support patterns.

When interpreting

extreme candlestick patterns using Relational Analysis, the following is the

order in which to proceed with the chart analysis:

1. Look at Price

first.

In this chart example

after a huge gap and run down, price has shifted to an ever tightening

Compression pattern. Compression patterns tend to form before a sudden breakout

aka Momentum or Velocity run.

2. Next look at

Volume.

In this chart example

the huge extreme Volume spike, that forms as the stock plummets right into a

prior Dark Pool Buy Zone. This is an exhaustion pattern on Volume to the

downside. High Frequency Traders HFTs are computer algorithms that often drive

price down into a Buy Zone. How price behaves after the price gap and run down

on extreme Volume, is a key element in Relational Analysis.

3. Finally look at

Support Levels.

Looking for Support

is the technical aspect of this analysis. Price is holding at this level for a

reason, and not by accident or coincidence. In addition, Price is compacting

tightly for a reason. The Accum/Dist indicator has turned up after hitting the

bottom of its indicator chart window, and the Money Flow Index MFI indicator is

above its Exponential Moving Average EMA in the bottom chart window. Both

reveal Dark Pool Time Weighted Average Price TWAP orders. TWAP is a specific

type of order that triggers automatically over an extended period of time,

creating a consistent pattern in Price action, Volume, Accumulation, and Flow

of Funds into a stock.

Below is a look at

the weekly chart view of this stock example which shows that it has indeed hit

a Dark Pool Buy Zone.

Summary

Momentum and Velocity

action out of an extreme bottom low are excellent opportunities for Swing and

Day Traders. Using Relational Analysis™ to identify potential candidates

early for momentum and velocity trading is best. Waiting until after the run

has already begun can use up much of the Point Gain Potential, which lowers

profits and increases risk.

For entries on these

patterns a trader must also consider underlying Momentum, overall Market Bias

for the entry day, strength of Indicators, Risk versus Point Gain Potential,

Support for the Stop Loss, and points to Resistance.

Go to the

TechniTrader.com Learning Center for more information HERE.

Sign Up for full access.

Followers may request

a specific article topic for this blog by emailing: info@technitrader.com

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a StockCharts chart, courtesy of StockCharts.com

Chartered Market Technician

Instructor & Developer of TechniTrader Stock and Option Courses

TechniTrader DVDs with every course.

©2016–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.

Disclaimer: All statements are the opinions of TechniTrader, its instructors and/or employees, and are not to be construed as anything more than an opinion. TechniTrader is not a broker or an investment advisor; it is strictly an educational service. There is risk in trading financial assets and derivatives. Due diligence is required for any investment. It should not be assumed that the methods or techniques presented cannot result in losses. Examples presented are for educational purposes only.