How to Determine When a Velocity Downtrend Is Reversing

Technical and Retail

Traders need to be able to identify Reversal Patterns during a downtrend in

order to avoid huge losses on selling short trades, and to be prepared and

ready for early entry in the reversal of the trend. When a downtrend concludes

with a V exhaustion pattern the extreme selling reverses suddenly, as stocks

drop into the Buy Side Institutions Dark Pool Buy Zones™ where Time Weighted

Average Price TWAP orders trigger automatically reversing the trend suddenly,

even mid-day.

Many times Technical

and Retail Traders are either waiting out the downtrend as they do not Sell

Short, or are Selling Short without adequately preparing for the inevitable end

of the downtrend.

The faster a stock

falls and the steeper the Angle of Descent™ then the faster it will rise, once

it enters a Dark Pool Buy Zone.

Candlestick Reversal

Patterns include Hurdles, Pole Vaults, Engulfing Whites, Springboards, Reversal

Upside, and the Sandwich are a few of the most common and most reliable candle

patterns that form in the automated stock market today.

Reversal Indicators

include Volume above average, Volume Surge caused by Professional Traders not

High Frequency Traders HFTs, Volume Downside Exhaustion Pattern, Dark Pool

Shift of Sentiment™ and Volume Oscillation Extreme Downside Spike, as well as

Extreme Flow of Funds. These patterns are some of the most common and most

reliable confirmation reversal indicator patterns that form today due to the

automation of the market, variety of venues, and plethora of professional order

types that are not available to Retail Traders.

The combination of

reversal candle patterns with reversal indicator patterns as confirmation,

provides the optimal reversal analysis. Identifying Reversal Patterns provides

early entry into the run and most gain potential.

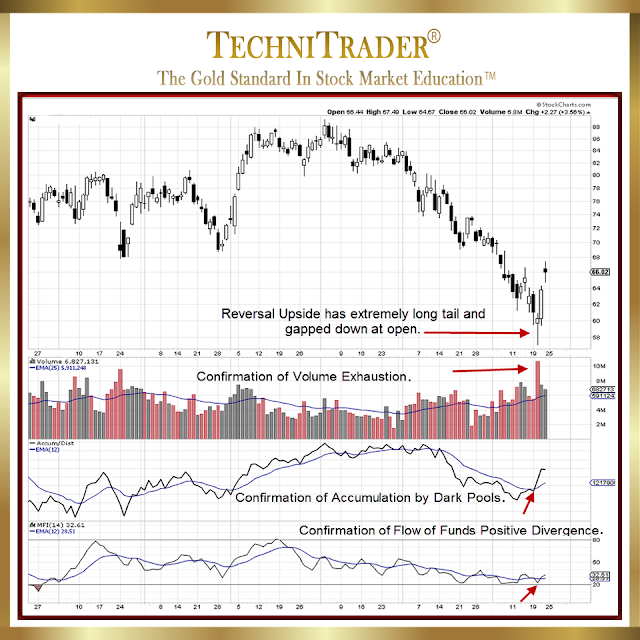

The chart example

below of EOG Resources, Inc (EOG: NYSE) recently had a strong reversal candle

and indicator confirmation pattern. It has moved approximately 5 points since

the reversal pattern formed.

In this chart example

the candlestick as indicated by the red arrow, is a Reversal Upside entry

signal which requires:

1. Tail or “lower

shadow” must be 3 times the length of the body of the candlestick.

2. A gap down on the day

that the Reversal Upside formed.

3. Confirming indicators

that this is a true reversal and not a Bounce or Buy to Cover.

Confirming indicators

for this chart example are the following, with red arrows in the chart windows

showing the confirmation:

1. Volume Exhaustion

Pattern to the downside, which is the red bar spiking to the top of the volume

indicator chart window.

2. Crossover of

Accum/Dist indicator in the middle chart window.

3. Money Flow Index MFI

indicator in the bottom chart window with a Positive Divergence.

Identifying true

reversal signals early provides lower risk entries with higher points gain, as

most velocity exhaustion patterns reverse with stronger upside velocity action.

Often HFTs will also trigger, moving price up further or causing a gap

up.

Summary

Reversal Patterns for

the modern automated stock and options markets are different than the reversal

patterns of just a few years ago. This is due to the plethora of trading venues

and order types available to the professional side of the market and the

institutions.

Go to the

TechniTrader Learning Center for more information HERE.

Sign Up for full access.

Followers may request

a specific article topic for this blog by emailing: info@technitrader.com

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a StockCharts chart, courtesy of StockCharts.com

Chartered Market Technician

Instructor & Developer of TechniTrader Stock and Option Courses

TechniTrader DVDs with every course.

©2016–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.

Disclaimer: All statements are the opinions of TechniTrader, its instructors and/or employees, and are not to be construed as anything more than an opinion. TechniTrader is not a broker or an investment advisor; it is strictly an educational service. There is risk in trading financial assets and derivatives. Due diligence is required for any investment. It should not be assumed that the methods or techniques presented cannot result in losses. Examples presented are for educational purposes only.