Understanding Who Moves Price in Specific Ways

The Dow Jones

Industrials (DJ-30: INDEX) is the chart example for this study lesson blog

post, as well as the previous blog post. For the previous article lesson I

wanted the focus to be on the analysis of the candlestick patterns, and not on

the name of the chart example. It is important to realize there are patterns

within patterns of candlesticks regardless of whether it is price or value.

Indexes are NOT prices, they are formulated values.

The Dow 30 represents

30 companies. It used to represent 30 industries but no longer, and this skews

the Dow in favor of some industries over others. Therefore this index can skew

the true market breadth aka the broadness of the buying or selling among ALL 31

industries, classified by economists for the US economy of today.

I am hoping all of

you who are reading this have studied the previous blog post chart example, and

have made some notes so you can compare what I am saying to what you saw. If

not, please do so first, before continuing with this article.

The Dow 30 chart

example below shows the short-term bottom formation between January and

mid-February 2016.

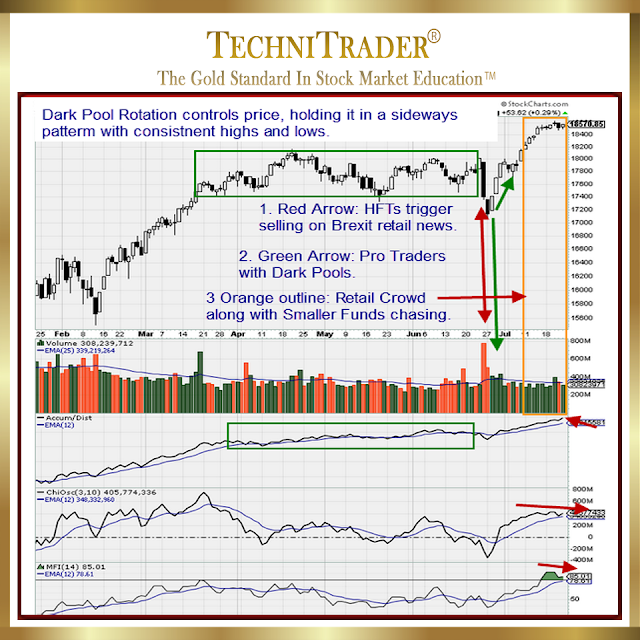

The Market

Participant Groups Cycle occurs in visual candlestick patterns on

the charts, and analysis should be confirmed with appropriate indicators. The

following is a break down of the Participant Groups by name in the cycle, and

the chart example shows their footprints.

Prior to this

short-term bottom, the Dow 30 had been in a weak Trading Range wide sideways

pattern after a “fake rally” in October 2015, brought about by Retail Traders

and Smaller Funds Market Participant Groups. The rally failed to break through

the resistance from May-July 2015 highs, which was a critical factor in

analysis of this Index at that time. Coupled with lower Volume, inconsistent

runs, and a lack of Dark Pool Accumulation continuation patterns the fake rally

collapse was obvious even before the steady lower highs of November-December.

The collapse of the fake rally in January caused many Smaller Funds to panic

and start selling, as their portfolios could not manage the selling spree

initiated by the High Frequency Trading Firms HFTs. This fueled the selling,

with of course retail news spurring smaller investors to fear and panic as

well.

Stocks plummeted to

the prior low Dark Pool Buy Zone™ around 15,500. The Dark Pool orders of Time

Weighted Average Price TWAP were there waiting to trigger large lots which are

100,000-400,000 and giant lots which are over 500,000 to buy specific Dow 30

components at bargain prices for Fundamentalists. Yes, there are many large to

giant lot orders still moving through the automated market system. You just

cannot see them anymore as they are ALL off-exchanges.

The Buy Zone was

fairly wide and halted the selling panic quickly.

A true rally followed

with Buy Side Institutions using Dark Pools raising their Buy Zones range for

the first time in over a year. This was instigated as Fundamentals slowly

caught up to stock prices. The Dow 30 moved up to the prior resistance level

from 2015-2016 and halted, as the Dark Pools ceased buying well below that

level as is their normal pattern.

A tighter formation

developed which I outlined for you on the chart. This is a Platform Candlestick

Formation, and is the pattern of a combination of Accumulation in bottoming

stocks and Rotation in stocks that fundamentally are breaking down as their

business cycle contracts well ahead of a Topping Formation. This is called

“adjusting inventories to maintain Alpha” for that fund. Most of these giant

Institutions have at least one to several S&P500 Funds, which are also Dow

30 components. That is why those two Indexes tend to behave more closely

aligned to each other, than with the NASDAQ 100.

HFTs caused the 2 day

Sheer Cliff™ Topping Formation collapse. Volume Weighted Average Price VWAP

orders trigger on high Volume and so Smaller Funds sell orders fired off. This

hit Retail Traders stops, and prices of components fell at an Angle of Descent™

that was unsustainable.

Then Professional

Traders jumped in buying, and created a Velocity Run™ which ran price back up.

Professionals reacted because they saw the liquidity draw from the exchanges as

Dark Pool orders surfaced when stocks fell into their Buy Zones again. The

liquidity draw is something Professionals watch for, and you can see the

Professionals footprints on the candlestick stock charts if you are using the

correct indicators.

As the Dow 30

rebounded the Retail crowd and Smaller Funds remained firmly staunched in panic

mode, certain that the British Brexit Vote would mean that a Bear Market was

imminent. It does not, because the Brexit Vote was never a US Stock Market

event. Buy Side Institutions using Dark Pools, paused their orders as stock

prices rose beyond their Buy Zones.

Values stalled for a

few days as the Smaller Funds dumping stock, was countered by the Professional

Traders buying. Then the values broke through the resistance barrier.

Immediately, Professionals halted their buying to see if Retail Traders would

suddenly shift their sentiment as they are known to do.

The activity last

week was Tiny Funds which are the funds with less than 5 million assets under

management to Smaller Funds, Retail Traders, and Odd Lot Investors Market Participant

Groups. The candles weakened instantly as Professionals ceased buying to wait

for an opportunity to take profits. Stock prices wavered, candles shrunk, and

the run rounded. Volume dropped as is typical when the Retail crowd takes

control.

Summary

When you know who is

controlling the price of a stock then you are able to trade with knowledge,

beyond the mere candlestick pattern or indicator crossover which tend to give

false signals at times. You know how price will behave as different Market Participant

Groups react to news, facts, or information that other Market Participant

Groups do not have access to.

Study a chart NOT

just by looking at Candlesticks or Indicators but as a story that is constantly

unfolding, telling you which of the 9 Market Participant Groups is in control

of price at that moment. If you do, profitability and reliability of each trade

will improve quickly.

To see the

TechniTrader customized tools, indicators, scans, and webinars available for

StockCharts users go to the TechniTrader partner page HERE. Sign Up for full access.

Followers of this

blog may request a specific article topic by emailing: info@technitrader.com

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a StockCharts chart, courtesy of StockCharts.com

Chartered Market Technician

Instructor & Developer of TechniTrader Stock and Option Courses

TechniTrader DVDs with every course.

©2016–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.

Disclaimer: All statements are the opinions of TechniTrader, its instructors and/or employees, and are not to be construed as anything more than an opinion. TechniTrader is not a broker or an investment advisor; it is strictly an educational service. There is risk in trading financial assets and derivatives. Due diligence is required for any investment. It should not be assumed that the methods or techniques presented cannot result in losses. Examples presented are for educational purposes only.