Calculating Costs to Determine True Profit

Most everyone who has

studied something about Candlesticks can identify an Engulfing White. However,

just being able to recognize an Engulfing White does not mean you have the

skills necessary to use Candlesticks successfully.

One of the dismal

realities of the Stock Market is that the retail crowd has at best a mediocre

percentage of success rate trading stocks, regardless of whether they are a

Long-term Investor or an Intraday Trader. A vast majority of new and beginning

traders lose most of their capital and then give up. The reason the Retail

Trader persists as a major Market Participant Group is solely the huge numbers,

which are millions of independent Americans who try to learn to trade stocks.

Recently the

Securities and Exchange Commission SEC has determined that a few “Retail

Traders” are becoming more successful, and a few of those actually reach

professional level percentages of success.

Many Retail Traders

are told falsely that if they have a 50% success rate, meaning half of their

traders are somewhat profitable, they are fine. The reality is that no

professional could keep his or her job at that percentage. The Professional

enjoys a high income due to an 80-90% or greater success rate trading Stocks,

Options, Commodities, Currencies, and other financial market instruments. They

do this with extremely proficient Spatial Pattern Recognition Skills™ using

Technical Analysis and Candlesticks in a relational manner.

How good are your

Spatial Pattern Recognition Skills? Take this test and see where you are in the

basics of Candlestick Pattern recognition skills.

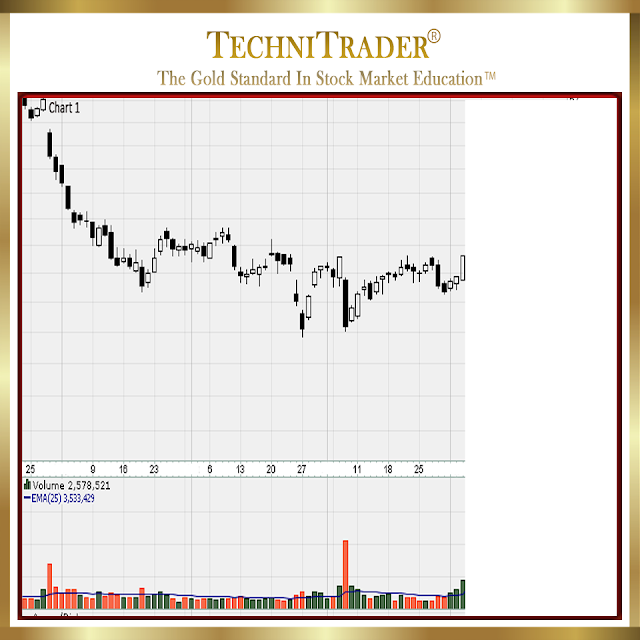

Below are 3 charts

with similar setups of Engulfing Whites, after a period of Consolidation.

If you are setting

.10 cents, .20 cents, or $200 per day as your goal then you are limiting your

profit potential and one big loss could potentially be devastating. Calculating

costs to determine true profit needs to include considering the cost of the

trade, cost of software, transaction fees, brokers, and calculating how much

are you worth an hour. Subtract the total number of hours you put into that

trade plus every expense, which should include your home trading office costs

as well. The net is your true profit.

Summary

Unfortunately most

Retail Traders never stop to do the math and are losing money every time they

trade, even if the trade appears profitable before all expenses are subtracted.

Sign Up

to watch the TechniTrader “How To Trade the Stock Market Webinar”

Sign Up also gives

you full access to the TechniTrader StockCharts “Learning Center”

Followers of this

blog may request a specific article topic by emailing: info@technitrader.com

Trade Wisely,

Martha Stokes CMT

TechniTrader technical analysis using a StockCharts chart, courtesy of StockCharts.com

Chartered Market Technician

Instructor & Developer of TechniTrader Stock and Option Courses

TechniTrader DVDs with every course.

©2016–2024 Decisions Unlimited, Inc. dba TechniTrader. All rights reserved.

TechniTrader is also a registered trademark of Decisions Unlimited, Inc.

Disclaimer: All statements are the opinions of TechniTrader, its instructors and/or employees, and are not to be construed as anything more than an opinion. TechniTrader is not a broker or an investment advisor; it is strictly an educational service. There is risk in trading financial assets and derivatives. Due diligence is required for any investment. It should not be assumed that the methods or techniques presented cannot result in losses. Examples presented are for educational purposes only.